Bringing the power of data to cooperatives

Cooperatives working for decades have become a data mine. They have recorded and managed huge amounts of data such as contributions, loans, shares, income, account balances etc. This data, if...

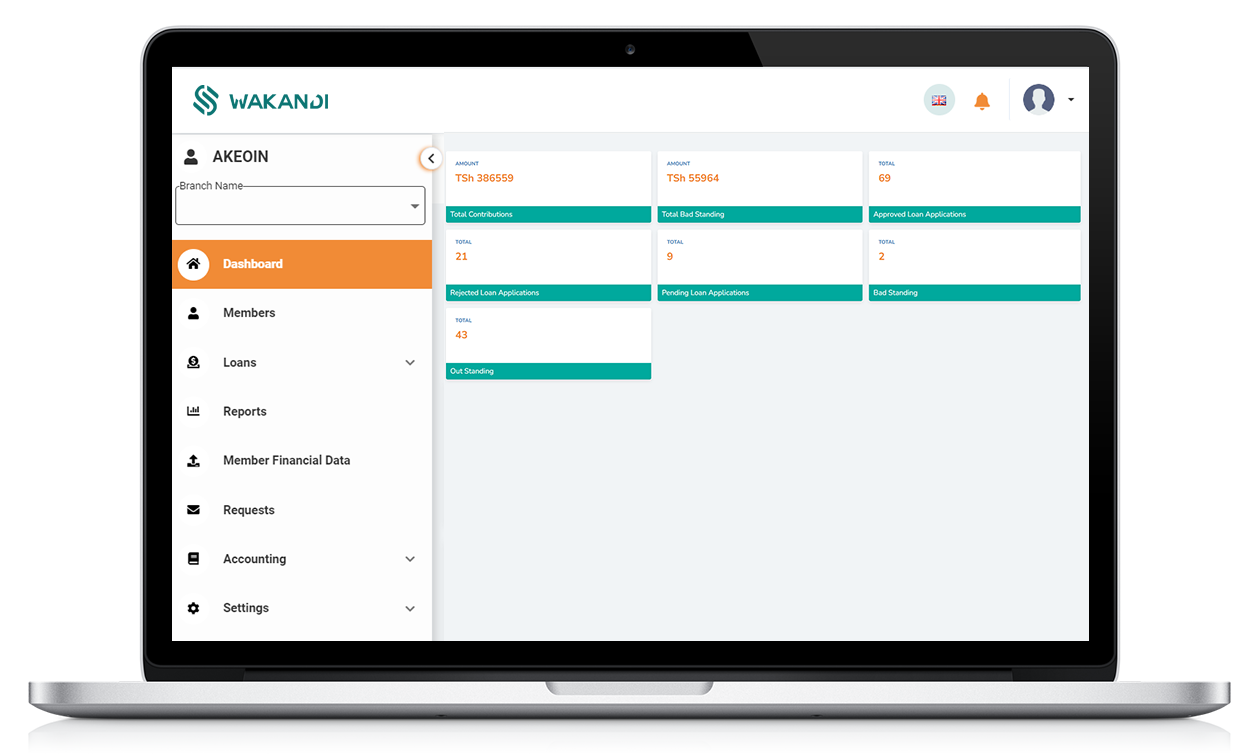

Wakandi is a digital financial system for savings groups and MFIs to manage savings and loans, transaction records, member data, and other operations digitally.

Wakandi enables the members to deposit contributions, apply for loans and manage finances, all via a mobile phone.

-2.png?width=1201&height=1201&name=MicrosoftTeams-image%20(3)-2.png)

-2.png)

Our pricing philosophy is inspired by the cooperative (people first) approach of SACCOs.

It enables us to offer users a cost-effective and transparent pricing experience.

You can read more about it here.

Cooperatives working for decades have become a data mine. They have recorded and managed huge amounts of data such as contributions, loans, shares, income, account balances etc. This data, if...

Savings and credit cooperatives (SACCOs) are member-driven organizations that offer members savings, investments and credit facilities to generate revenue. As they operate, they promote a culture of...

More than 1.2 million boda boda riders are working to provide transport and delivery services in Kenya. It is estimated that every rider makes 15 rides on average a day to fulfil their jobs and to...